The Confident Chronicles: April 19, 2024

Cool Charts Explained: Market Returns:

This is “non-normal” communication being delivered mid-month due to the changes occurring in the (Semi) Tactical Plan Confidence models.

The S&P 500 has gone from a positive return of 3.50% as of April 1st to now down almost 2 percent.

This downward sell off has occurred over the past couple of weeks.

Our technical indicators for the month of April are below:

As you can see, there is a lot of yellow (hold), green (buy) and red (sell) signals.

Our models will sell off half of the equity (stock) positions) when two or more signals go to “sell” for 3 consecutive days.

As you can see from our research above, the 50/200 day moving average (50/200 DMA), the Moving Average Convergence Divergence (MACD) and the Volatility Index (VIX) have all been negative since April 15th.

We wait three days for consecutive “sell” signals to rule out any false “positive” or “negative” movements. This is to try and prevent frequent trading in a “whiplash” type of market.

You can see that the only “buy” signal on 4/17/2024 is the Relative Strength Indicator (RSI) which has sunk so low, it is showing that the market may be oversold for a short period.

Since three technical indicators have shown “sell” signals for three consecutive days, we have updated the Plan Confidence Tactical Models.

Our Strategic Models have not been affected by these indicators as those are always fully allocated.

Cool Charts Explained: Market Barometer

What a difference between the U.S. Market Barometer from April 1st until today.

On April 1st, all of the boxes for all three time frames were green.

We see here that the past month shows that every stock size and category has been selling off.

As expected, the Small Cap stocks are faring the worst.

However, I am a little surprised that the Large and Small Growth and Value styles are suffering almost the same fate.

It appears that the Large Cap Core category suffered the least.

This would lead me to believe that investors are selling off most of their positions in everything but the S&P 500.

If this hypothesis is true, it shows that investors have some faith in the overall economy and the stock market as a “whole”, but they are very concerned about sectors and individual names.

PLAN CONFIDENCE MODEL UPDATES:

FUTURE CONTRIBUTIONS:

Future contributions are money that is added to your plan with every paycheck. We monitor the future contributions monthly and are looking to direct these monies into investments that are should be “on sale”. This would allow you to buy more shares in your portfolio.

This month we are advising that you use the following:

There are no changes from the April 1, 2024 advice

The exact amounts you should allocate depend on the model that you are using. These categories may or may not be available in your plan. If they are not available in your plan, we will recommend the closest available asset class. You can find any substitutions on your “Proxy Page” within your dashboard. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

CURRENT ALLOCATIONS - STRATEGIC MODELS:

Our “Strategic Models” combine the benefits of asset allocation and “buy and hold” strategies. These models rebalance quarterly back to their risk “targets” and remain fully invested through all market cycles.

Our Strategic Models rebalance the first trading day of every quarter.

There are no changes from the April 1, 2024 advice

The exact amounts you should allocate depend on the model that you are using. The categories we use may or may not be available in your plan. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

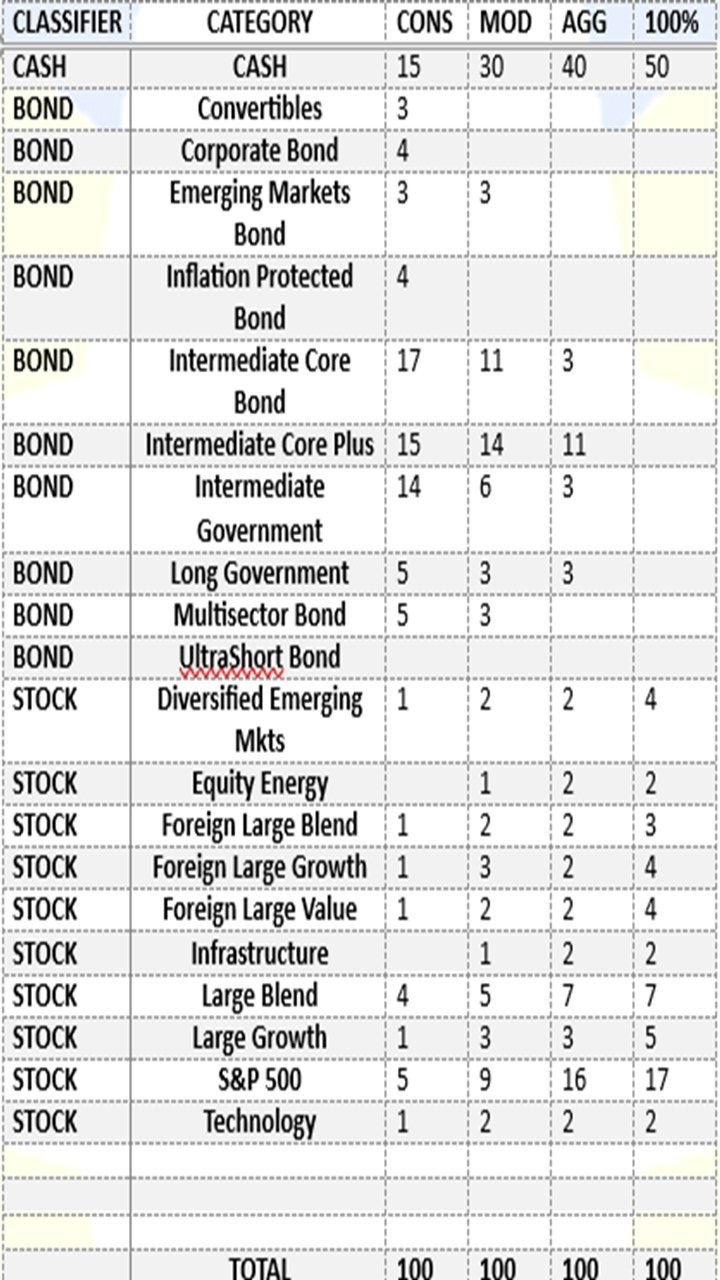

CURRENT ALLOCATIONS - TACTICAL MODELS:

Current Allocations are the monies currently in your plan. Making changes to this money is known as a “rebalance”. Some plans have trading restrictions on how often you can rebalance the money in your plan.

Be sure to know your plan’s restrictions before implementing any strategies.

Today our “Tactical” models are recommending that half of the stock positions be liquidated and moved to “cash”.

This is due to the technical indicators that we follow which have shown “sell” signals for the past three days.

We know that this may cause some issues for some participants that have short term trading restrictions within their plan since that last rebalance occurred on April 1st.

The participant will need to decide if they should trade their account as recommended by Plan Confidence or wait until their short-term trading restrictions are no longer an issue.

Below are the Asset Categories for each model.

Please check your Plan Confidence Participant Dashboard for the exact amounts and investments available in your plan.

New advice as of 4/19/2024:

Our “Tactical Models” combine the benefits of asset allocation and “momentum investing” strategies. These models rebalance periodically back to their risk “targets” and the targets can be changed at any time given the current market conditions. These models may go through periods of time while holding larger amounts of cash than the Strategic Models.

Our Tactical Models may rebalance on any given day. Please be sure to look for an email from support@planconfidence.com letting you know when to make changes. Also, be sure to keep our “push” notifications “on” if using our app.

The exact amounts you should allocate depend on the model that you are using. These categories may or may not be available in your plan. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

Model Portfolio Rationale:

Plan Confidence relies on the research and model construction from BlackRock, Inc. (the largest asset manager in the world). We use their “Target Allocation ETF Multi-Manager” model and “deconstruct” their allocations back to the asset categories to program the Plan Confidence™ Software.

We then map those categories as closely as we can to the available investment options that you have in your plan.

Below are some excerpts from the most recent market research report we rely upon to advise you.

· The markets are still adjusting to sticky inflation and structurally higher interest rates

· We think investors need to grab the investment wheel and take a more dynamic approach to their portfolios

· We see little in the near term to disrupt the market’s perception that inflation is slowing, growth is holding up and rate cuts are coming. We think the risk of resurgent inflation could eventually dent the mood.

· Even with the U.S. economy’s resilience through 2023, activity remains below its pre-Covid trend growth rate.

To read the full article and download the PDF check out:

This update has been written by Kevin T Clark, RF™.

All opinions expressed are those of the author and not that of Plan Confidence Corporation nor any other firm or individual.

Kevin T Clark, RF™ is the CEO and Co-founder of Plan Confidence Corporation.

Kevin is an ERISA Nerd and one of only a hundred(ish) Dalbar certified Registered Fiduciaries (RF™) in the United States.

He has been helping hard working Americans invest their money since 1997!

Plan Confidence Corporation is an SEC registered investment firm specializing in providing advice to hard-working Americans investing in their employer’s retirement plans (401k, 403b, TSP, etc). They have created proprietary software so hard-working Americans can receive professional, ongoing advice on their employer’s retirement plan from an adviser of their choosing!

#401kAdvice #403bAdvice #TSPadvice #BeConfident #got401k