The Confident Chronicles: April 1, 2024

Intermediate term bonds have staged a rally and turned positive for the year. Also, the “tech rally” has lost a lot of its momentum as its return have been on par with bonds. Non-technology stocks have outperformed in the past month.

We are coming off a 4-week period where only two categories of the 61 we monitor actually lost money (Latin American Stock -0.78% and Health Stocks -0.87%).

Precious metals was the only category up double digits as an outlier of the group and was up over 17% for the past four weeks.

However, the S&P 500, was up just 3.50% in the same time frame.

This is encouraging news, especially considering there were a couple of reports that inflation is starting to rise faster than “the Fed” had anticipated, pushing future interest rate cuts to later in the year.

However, the “risk on” appetite was alive and well for the month of March.

Time will tell if this momentum carries forward into April. The “earnings season” will determine if this rally continues. Earnings season is where the public companies disclose their quarterly results and many will give their “guidance” (best guess) on what the rest of the year should look like for their company.

Usually the CEOs paint a very rosy picture of how amazing their company is. This is rewarded with a higher stock price, until their quarterly results show differently.

I do not expect many “surprises” during the earnings season. Which means, April (in my professional opinion) should continue the forward momentum of the markets.

However, with the markets setting new all-time highs, any negative headline could derail the rally. There is a lot of cash sitting on the sidelines earning a decent rate (5%) in the bank. There could be a switch to a “risk off” market while our interest rates in banking products remain high.

The Plan Confidence Models have been updated with the new quarter. Both the Strategic and the Semi-tactical models have new allocations.

Read below for more information about the changes that are being made.

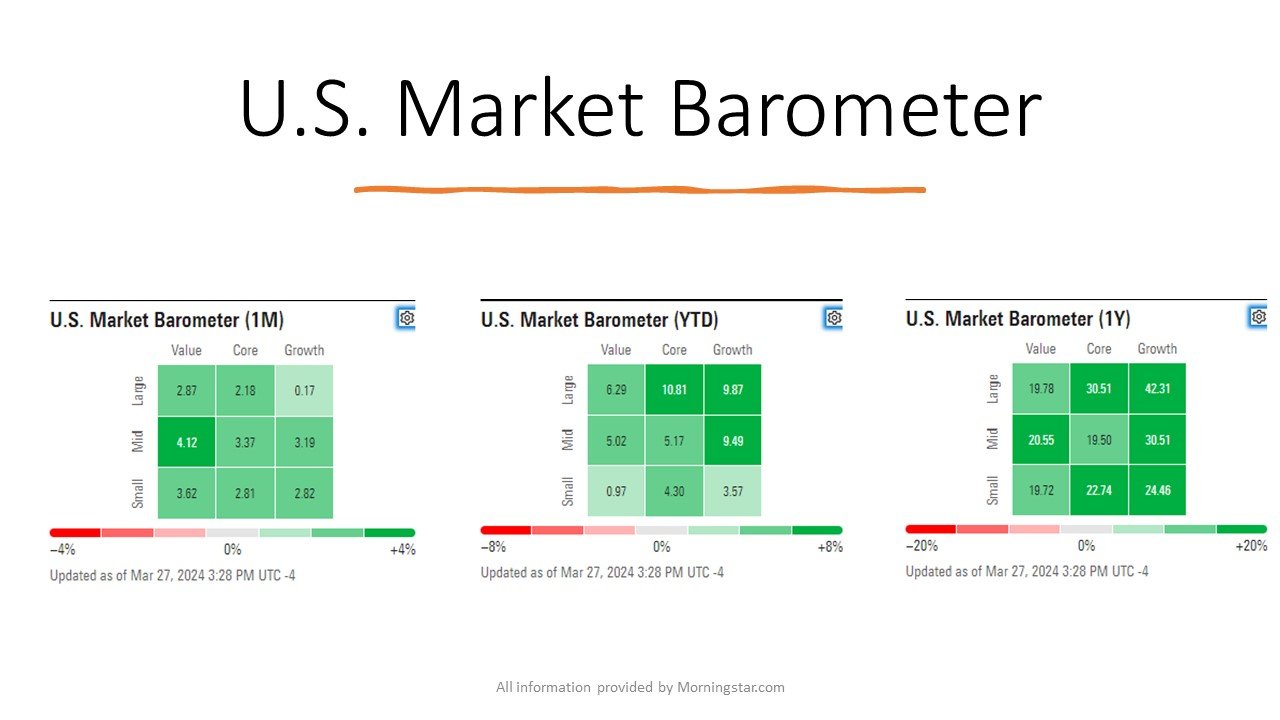

Cool Charts Explained: Market Barometer

There are a couple of things that stick out like sore thumb in the above data.

First, for the past 1 Month, Year-to-date, and 1 Year time frames, all of the boxes are green. From small to large stocks and from Value to Growth, everything has been in the green. It has been hard to lose money in stocks during this rally.

The other thing that jumps off these charts is the changes in leadership that are taking place.

And what I see is very contradictory.

First, for the past month, large stocks have been lagging their small and mid-sized peers. This is usually the sign of a “risk on” appetite.

However, there has been a shift from growth to value style of investing. This is usually a sign of a “risk off” appetite.

So, while it appears that investors are willing to look to smaller returns in search of higher returns, they are also doing so carefully.

We will need to wait and see if the “risk on” or the “risk off” appetite prevails.

PLAN CONFIDENCE MODEL UPDATES:

FUTURE CONTRIBUTIONS:

Future contributions are money that is added to your plan with every paycheck. We monitor the future contributions monthly and are looking to direct these monies into investments that are should be “on sale”. This would allow you to buy more shares in your portfolio.

This month we are advising that you use the following:

· Convertible Bonds

· Equity Precious Metals

· Equity Mid-Cap Value

The exact amounts you should allocate depend on the model that you are using. These categories may or may not be available in your plan. If they are not available in your plan, we will recommend the closest available asset class. You can find any substitutions on your “Proxy Page” within your dashboard. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

CURRENT ALLOCATIONS - STRATEGIC MODELS:

Current Allocations are the monies already in your plan. Making changes to this money is known as a “rebalance”. Some plans have trading restrictions on how often you can rebalance the money in your plan. Be sure to know your plan’s restrictions before implementing any strategy or rebalances.

April is the time for a quarterly rebalance of your assets. Below is a chart of changes that are being recommended and the differences between the first quarter and the second quarter.

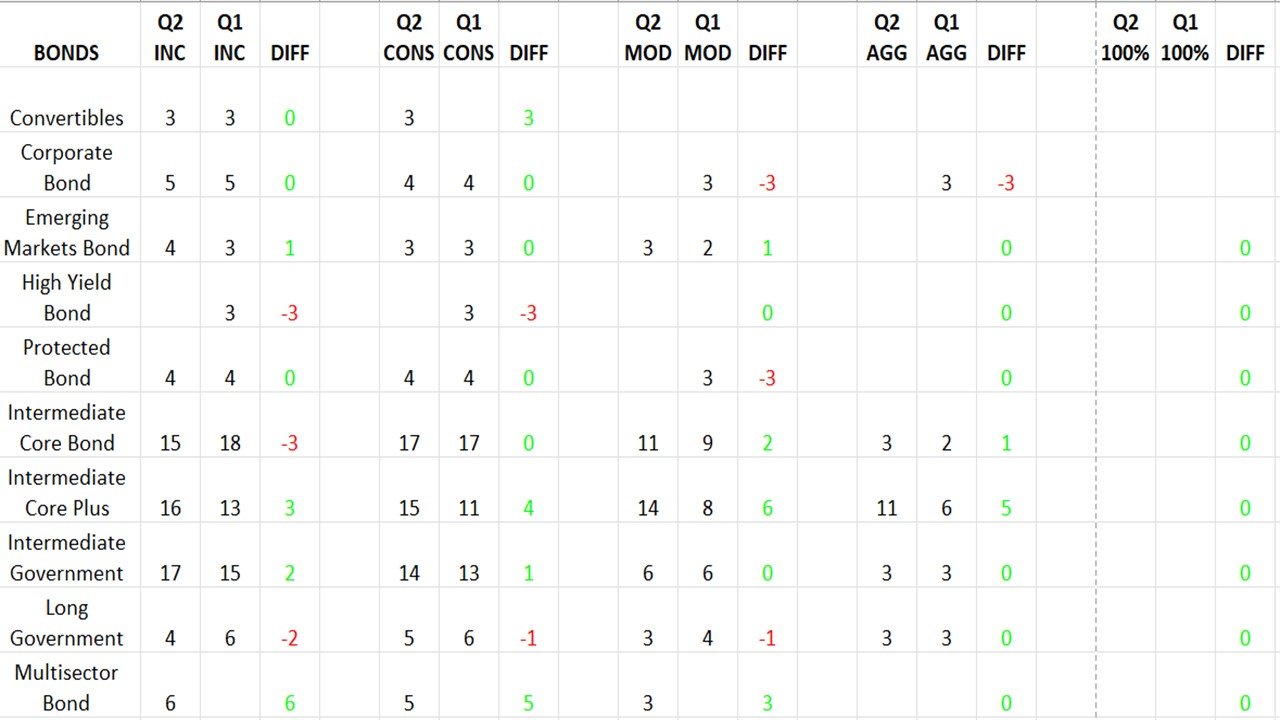

Bond Allocations:

Above are the changes made to the Bond Allocations from the 1st quarter to the 2nd.

We are no longer recommending any allocations to the High Yield category, and we have added allocations to the Multi-Sector Bond category.

We have reduced the exposure to both the Long Duration and Ultrashort duration bonds and increased the allocation to the Intermediate Core Plus category.

Stock Allocations:

Above are the changes made to the Stock Allocations from the 1st quarter to the 2nd.

We are reducing the amounts allocated to the S&P 500, Foreign Large Value and the Large Blend categories.

We are also increasing the allocations to Emerging Markets, Energy, Foreign Large Blend and Large Growth.

Our “Strategic Models” combine the benefits of asset allocation and “buy and hold” strategies. These models rebalance quarterly back to their risk “targets” and remain fully invested through all market cycles.

Our Strategic Models rebalance the first trading day of every quarter.

The exact amounts you should allocate depend on the model that you are using. The categories we use may or may not be available in your plan. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

CURRENT ALLOCATIONS - TACTICAL MODELS:

Current Allocations are the monies currently in your plan. Making changes to this money is known as a “rebalance”. Some plans have trading restrictions on how often you can rebalance the money in your plan. Be sure to know your plan’s restrictions before implementing any strategies.

All Tactical Models have been updated for the 2nd quarter.

(The Strategic and Tactical Models have the exact same allocations at this time.

Please see the rationale above in the Strategic Models for the verbiage about the changes being made for the 2nd quarter.)

Our “Tactical Models” combine the benefits of asset allocation and “momentum investing” strategies. These models rebalance periodically back to their risk “targets” and the targets can be changed at any time given the current market conditions. These models may go through periods of time while holding larger amounts of cash than the Strategic Models.

Our Tactical Models may rebalance on any given day. Please be sure to look for an email from support@planconfidence.com letting you know when to make changes. Also, be sure to keep our “push” notifications “on” if using our app.

The exact amounts you should allocate depend on the model that you are using. These categories may or may not be available in your plan. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

Model Portfolio Rationale:

Plan Confidence relies on the research and model construction from BlackRock, Inc. (the largest asset manager in the world). We use their “Target Allocation ETF Multi-Manager” model and “deconstruct” their allocations back to the asset categories to program the Plan Confidence™ Software.

We then map those categories as closely as we can to the available investment options that you have in your plan.

Below are some excerpts from the most recent market research report we rely upon to advise you.

· The markets are still adjusting to sticky inflation and structurally higher interest rates

· We think investors need to grab the investment wheel and take a more dynamic approach to their portfolios

· We see little in the near term to disrupt the market’s perception that inflation is slowing, growth is holding up and rate cuts are coming. We think the risk of resurgent inflation could eventually dent the mood.

· Even with the U.S. economy’s resilience through 2023, activity remains below its pre-Covid trend growth rate.

To read the full article and download the PDF check out:

##

This update has been written by Kevin T Clark, RF™.

All opinions expressed are those of the author and not that of Plan Confidence Corporation nor any other firm or individual.

Kevin T Clark, RF™ is the CEO and Co-founder of Plan Confidence Corporation.

Kevin is an ERISA Nerd and one of only a hundred(ish) Dalbar certified Registered Fiduciaries (RF™) in the United States.

He has been helping hard working Americans invest their money since 1997!

Plan Confidence Corporation is an SEC registered investment firm specializing in providing advice to hard-working Americans investing in their employer’s retirement plans (401k, 403b, TSP, etc). They have created proprietary software so hard-working Americans can receive professional, ongoing advice on their employer’s retirement plan from an adviser of their choosing!

#401kAdvice #403bAdvice #TSPadvice #BeConfident #got401k