The Confident Chronicles: March 1, 2024

Cool Charts Explained: Market Returns

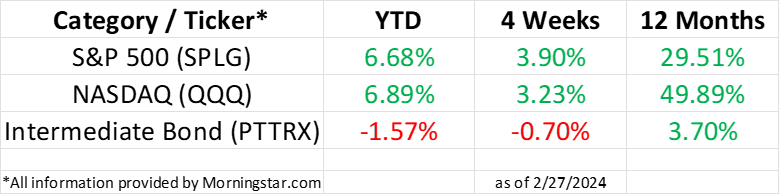

February is the identical twin of January. I wrote everything in italics below last month and it is exactly the same for this month. Every word is the same for February as it was in January.

The stock markets are off to a positive start for the year. It’s a “cautious” start to what is expected to be a roller coaster of a year. There is a lot of “headline risk” expected this year with the U.S. funding two wars, a Congress that cannot create a long term funding strategy for the government and (of course) the Presidential Election later in the year. Combine that that with talk of a possible recession (which was talked about and never came to fruition last year).

The bond market is struggling a little to start the year off. Bonds are mostly effected by interest rates. If interest rates go up, long term bonds go down in value. If interest rates go down, long term bonds go up in value. There is much anticipation that “The Fed” will be cutting interest rates this year (which would be good for the value of issued Long Term bonds). We will see if “The Fed” gives us any indication of their thinking when their notes are released from yesterday’s meeting in the near future.

Cool Charts Explained: Market Barometer

In January we saw the “Growth” style investing continue to dominate the returns. The Large Growth category has outperformed the Year-to-date (YTD) and One year (1Y) time frames. However, Mid Cap Growth outperformed all of the nine categories in January.

The outperformance of the growth categories shows that investors are still willing to take risks. It almost didn’t matter if you were buying Large, Mid or Small cap stocks, as long as they were “growth” stocks.

However, the year-to-date (YTD) numbers show that the Large Core category is starting to gather some momentum as well. This can show that investors are not putting all their money in the Large Growth stocks anymore. They are starting to “hedge their bets” by adding money to the Large Core category as well.

The concern is the small cap stocks are dramatically underperforming their larger categories. Normally, we see the small stocks “lead” a rally. So, one would have to assume the Large Company outperformance is fragile and could change rapidly if there is any headline risk or higher than expected inflation numbers.

Time will tell.

PLAN CONFIDENCE MODEL UPDATES:

FUTURE CONTRIBUTIONS:

Future contributions are money that is added to your plan with every paycheck. We monitor the future contributions monthly and are looking to direct these monies into investments that are should be “on sale”. This would allow you to buy more shares in your portfolio.

This month we are advising that you use the following:

· Equity Energy

· Intermediate Government

· Small Value

The exact amounts you should allocate depend on the model that you are using. These categories may or may not be available in your plan. If they are not available in your plan, we will recommend the closest available asset class. You can find any substitutions on your “Proxy Page” within your dashboard. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

CURRENT ALLOCATIONS - STRATEGIC MODELS:

Current Allocations are the monies currently in your plan. Making changes to this money is known as a “rebalance”. Some plans have trading restrictions on how often you can rebalance the money in your plan.

There are NO CHANGES to our Strategic Models for this month.

(Last Rebalance was on Tuesday, January 2nd)

Our “Strategic Models” combine the benefits of asset allocation and “buy and hold” strategies. These models rebalance quarterly back to their risk “targets” and remain fully invested through all market cycles. Our Strategic Models rebalance the first trading day of every quarter.

The exact amounts you should allocate depend on the model that you are using. The categories we use may or may not be available in your plan. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

CURRENT ALLOCATIONS - TACTICAL MODELS:

Current Allocations are the monies currently in your plan. Making changes to this money is known as a “rebalance”. Some plans have trading restrictions on how often you can rebalance the money in your plan.

There are NO CHANGES to our Tactical Models for this month.

(Last Rebalance was on Tuesday, February 1st)

Our “Tactical Models” combine the benefits of asset allocation and a “momentum investing” strategies. These models rebalance periodically back to their risk “targets” and the targets can be changed at any time given the current market conditions. These models may go through periods of time while holding larger amounts of cash than the Strategic Models.

The exact amounts you should allocate depend on the model that you are using. These categories may or may not be available in your plan. Please log into your Participant Dashboard to see the exact allocations you should be using as of today.

Model Portfolio Rationale:

Plan Confidence relies on the research and model construction from BlackRock, Inc. (the largest asset manager in the world). We use their “Target Allocation ETF Multi-Manager” and “deconstruct” their models back to the asset categories to program the Plan Confidence Software. We then map those categories as closely as we can to the available investment options that you have in your plan.

Below are some excerpts from the most recent market research report we rely upon to advise you.

Fun Facts:

Fidelity has 11.5% more 401(k) millionaires this year than they did in 2023!

Their average 401(k) balance grew 14% to $118,600. This is short of the $135,600 balances in 2021, but higher than 2022.

Many workers (33%) increased their retirement contributions rate.

To read the full article, check out: https://www.cnbc.com/2024/02/27/401k-millionaires-and-average-balances-rose-in-2023-fidelity-says.html

This update has been written by Kevin T Clark, RF™.

All opinions expressed are those of the author and not that of Plan Confidence Corporation nor any other firm or individual.

Kevin T Clark, RF™ is the CEO and Co-founder of Plan Confidence Corporation. Kevin is an ERISA Nerd and one of only a hundred(ish) Dalbar certified Registered Fiduciaries (RF™) in the United States. He has been helping hard working Americans invest their money since 1997!

Plan Confidence Corporation is an SEC registered investment firm specializing in providing advice to hard-working Americans investing in their employer’s retirement plans (401k, 403b, TSP, etc). They have created proprietary software so any hard-working American can receive advice on their employer’s retirement plan from an adviser of their choosing!

#401kAdvice #403bAdvice #TSPadvice #BeConfident #got401k